What is the AllClear Health Network?

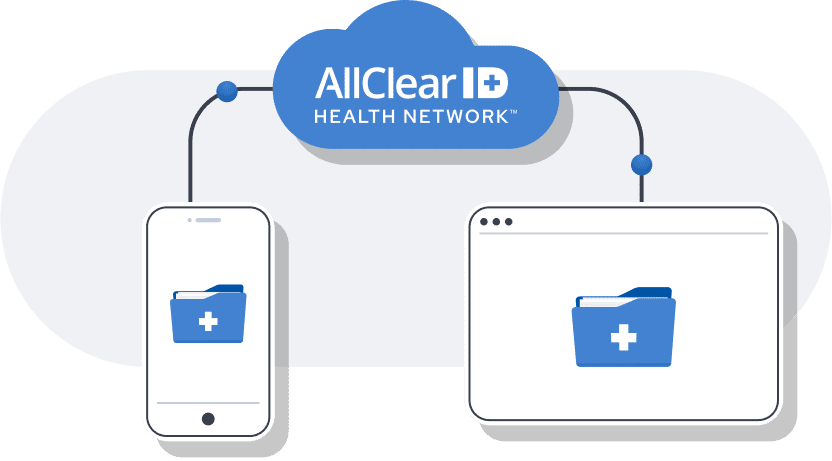

The AllClear Health Network is a two part system that does all the work to consolidate a patient's medical records from all providers and puts them in one place. So doctors and patients can access consolidated records at any time.

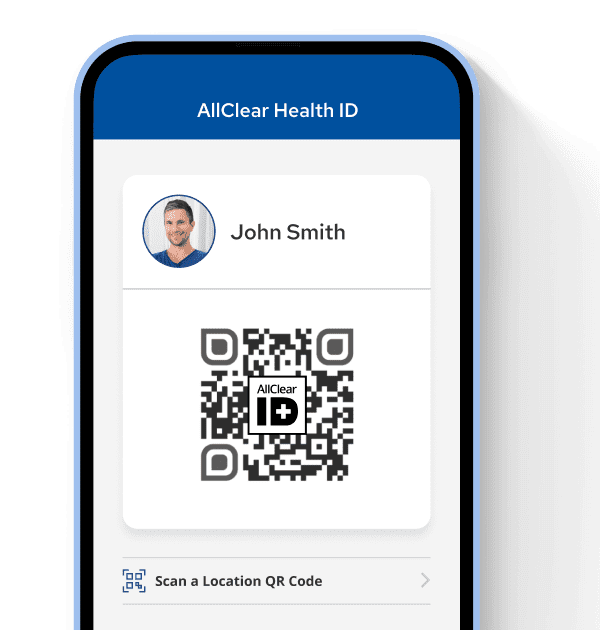

AllClear Health IDTM Mobile App

For Patients

Puts patients in control of their medical records from every provider.

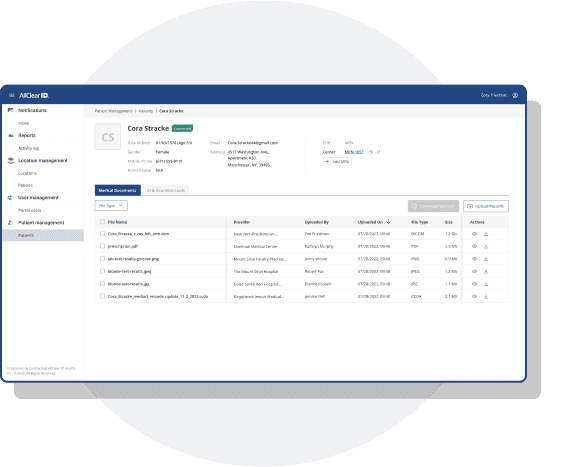

Learn moreAllClear Health ConnectTMFor Providers

Gives doctors and their staff instant access to a patient’s consolidated health record.

Learn moreHow It Works

Chasing down medical records from different providers can be time consuming and frustrating for doctors and patients alike. But now there is a simple and safe solution – the AllClear Health Network, the first and only system that gives you the most complete access to patient records.

Providers invite their patients to enroll in the Health ID mobile app.

Health ID™ goes to work retrieving the past 5 years of medical records.

Doctors access consolidated patient medical records, including image files.

Doctors download the records prior to appointments and import them into their EHR.

What It Does for Patients

Due to recent legislation, patients are entitled to their electronic health records from any provider. And with AllClear Health ID, they now can easily consolidate all their medical records and share them with any provider.- No matter where the patient goes, their medical records are always at hand

- Patients can connect and share records with any provider

- Accurate medical history and records for the last 5 years

What It Does for Doctors

With AllClear Health Connect, doctors have instant access to consolidated patient records including images.- No more faxing another doctor for records or burning CDs

- Doctors get the information they need prior to patient appointments, so that they can focus on delivering care during the visit

- Verified identity, insurance and demographic information to eliminate the #1 reason claims get denied – patient misidentification

- No IT support required

What it Delivers That No Other System Can Match

Proven banking grade securityAllClear ID’s technology has proven itself in banking where it is securely processing over 1 billion high value transactions annually with no scalable attacks. We are bringing that same technology and a decade of experience to Health ID to make it the most secure patient identity available.

Reduce Your Record Retrieval Work

by 90%

Your staff has better things to do than track down patient records. Having instant access to current patient records, including images, means you can unburden staff. No more phoning or faxing requests for records or fulfilling requests by burning CDs or sending documents.

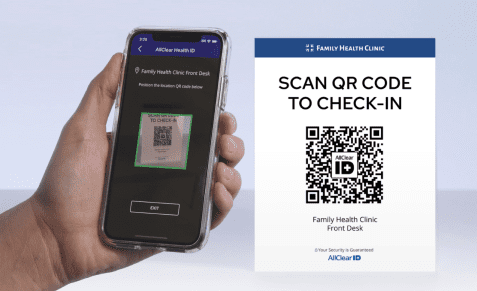

Add QR Codes to Make Patient Experiences Easy and Accurate

When a patient arrives for their appointment, they scan a QR code and avoid the line and skip filling out medical history forms. Doctors get accurate data and insurance information which eliminates misidentification and duplicate records. And accurate information means insurance reimbursements are greatly improved.

Bo Holland Launches AllClear Health ID at ViVE 2023

Bo Holland, Founder and CEO of AllClear ID, introduced AllClear Health ID at ViVE 2023. Watch the video to see him demo Health ID and listen to the podcast to hear an in-depth explanation of this groundbreaking product.

Our Promise

The AllClear Health Network is dedicated to retrieving your medical records from your medical providers. We’ll do the legwork to get the most complete records, so patients and doctors don’t have to.